Do you really Rating an FHA Mortgage getting a mobile House into the 2022?

Do you really Rating an FHA Mortgage getting a mobile House into the 2022?

The latest Federal Houses Administration (FHA) provides mortgage loans for modular, prefabricated, and you can mobile homes in order to qualified residents and you can qualified properties. Typically the most popular way of money an excellent prefabricated residence is by a frequent FHA mortgage. Generally, both the land as well as the prefabricated domestic is actually acquired along with her. The mark resident(s) have to meet the very first recognition criteria.

This new FHA home loan program is still among easiest a means to funds a house buy. The fresh new advance payment merely step three.5 percent and can even end up being “donated” by a qualifying donor (we.e. moms and dads, sisters, and you can significantly less than certain criteria, a buddy). Owner may security specific otherwise the consumer’s closing can cost you. Read more about FHA domestic-money

FHA are manufactured, modular and you can cellular house-financing direction

Because of the FHA’s be sure out-of FHA prefabricated lenders, specific conditions should be met. Included in this could be the following, not limited to:

- This new quarters need to have come mainly based after June fifteen, 1976.

- eight hundred sq ft is the lowest size which is often funded.

- For every items need to have the newest red HUD title.

- Our home must be permanently linked to a charity having become authorized by the FHA.

- The latest prefabricated residence’s venue should be anticipate.

- The house must adhere to the brand new Design Were created Home Setting up Conditions.

- The quarters must be the customer’s prominent house.

FHA Title I financing

The newest Government Housing Administration’s name step one financing system encourages the purchase otherwise refinancing regarding prefabricated land. A subject I financing can be used to purchase or refinance an effective prefabricated domestic, set-up property on what to create one to, or a mixture of both. The brand new borrower’s dominating domestic should be the hold.

Individuals commonly expected to individual otherwise very own the house or property to your which the prefabricated residence is based in purchase so you’re able to be eligible for Identity I covered financing. Rather, borrowers get lease a great deal, including a website package during the a created household people otherwise cellular domestic park.

In the event that home/package is actually leased, HUD requires the lessor giving a great three-12 months very first lease name towards the were created resident. On the other hand, the fresh new lease need identify that when brand new lease is going to be ended, the fresh citizen need to be provided about 180 days’ created see. These types of rent fine print are created to include residents in the event your lessors promote the latest land otherwise personal this new park.

two decades for a mobile financial otherwise a manufactured household and you will package mortgage in a single bit fifteen years having a good prefabricated household home mortgage A twenty five-year mortgage getting a multi-part prefabricated household and you will residential property Supply: Service regarding Homes and Financing

The brand new USDA and are created housing

The united states Company away from Farming (USDA) often enable the access to a produced mortgage loan to finance the acquisition away from an eligible the fresh product, shipping and you may setup costs, together with acquisition of a qualified site (if not currently owned by this new candidate).

Potential homeowners need see typical degree standards, which includes money, a career length, credit, monthly income, and you can monthly debt obligations. Find out more about USDA certification

When your tool and you may location is secure from the a bona fide estate mortgage otherwise deed out-of trust, a loan to fund next tends to be guaranteed.

Work with a web page one complies which have county and state government conditions. Purchase of a unique eligible device, transportation and options costs, additionally the acquisition of a different sort of qualified website should your candidate does not currently very own one. Are manufactured devices need to be lower than a year-old, unoccupied, and you can entirely contains in website.

The purchase contract must be performed in a single year of the are made date of the tool, due to the fact found to your plat. An excellent equipment that’s qualified for the newest SFHGLP make sure need fulfill the second criteria:

So you’re able to be considered, the newest tool must have at least living area of 400 sqft. This new prefabricated domestic have to conform to Federal Are created Household Structure and you may Safety Criteria (FMHCSS).

The product must be permanently mounted on a charity you to complies with latest FHA rules at the time of certification. HUD-4930.3G, “Are formulated Property Long lasting Basis Guide,” happens to be available online from the

The foundation structure was acknowledged to get to know the requirements of HUD Manual 4930.step 3, “Permanent Foundations Guide to own Are available Property (PFGMH).”

The foundation qualification must be awarded by an authorized professional engineer or entered designer who is registered otherwise registered throughout the state in which the are formulated home is situated and will approve one to the new are created domestic complies having latest PFGMH criteria.

New certification have to be website-particular you need to include the new signature, seal, and/or condition licenses/degree quantity of the newest designers or joined architects. Read more

Issues and Responses regarding Manufactured Lenders

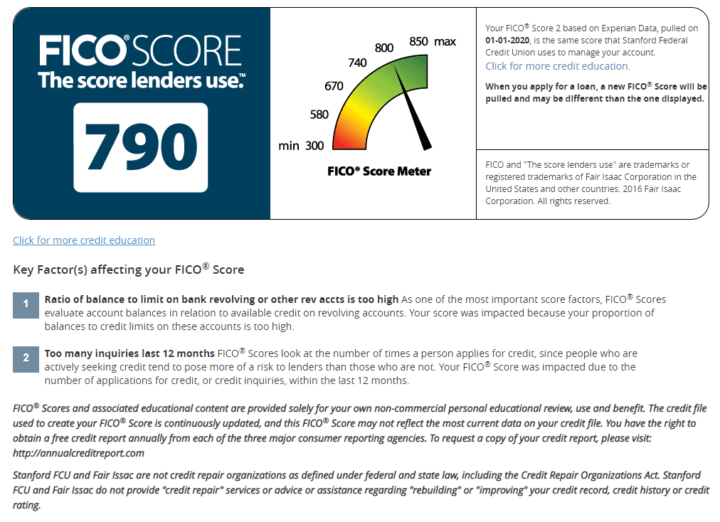

Q. Do i need to found a mobile home loan with dreadful borrowing from the bank? A good. The newest Federal Property Management (FHA) have a tendency to fund a mobile house in case the structure complies which have FHA requisite (find a lot more than) and the applicant(s) satisfy FHA’s important credit and you may earnings criteria. The brand new FHA encourage individuals having fico scores only five-hundred (up to 579), but requires a 10% advance payment. The latest limited deposit towards the a home that have a credit history from 580 otherwise over was step three.5 %.

Q. How can i get an FHA-covered mobile mortgage? A. Just submit an application to help you an enthusiastic FHA-approved lender.

Q. How long can it need to possess a cellular mortgage to help you become approved? A. Getting pre-acceptance otherwise mortgage approval usually takes only one to or 2 days, offering the candidate comes with the required documents (we.elizabeth. pay stubs, W-dos variations, lender statements, etcetera.).

Q. Simply how much advance payment is needed for the a mobile household? Good. As in the past indicated, a 3.5 per cent down payment required having individuals https://paydayloansconnecticut.com/noroton/ which have a credit score much better than 580.

Q. Is it difficult to get financing having a cellular house? A great. Loan approval is quite easy when compared to other kinds of mortgages.

Q. Is prefabricated house entitled to FHA investment? An excellent. Most likely. More firms are aware of the FHA’s building requirements to make all efforts to stick to him or her.

Brand new hand calculators and you will information on this site are given for your requirements since a personal-assist tool to own academic objectives merely. We cannot and don’t guarantee the appropriateness otherwise correctness of your suggestions on the specific situation. I highly suggest that you get individual the recommendations out of skilled advantages.