The essential difference between a property Guarantee Financing, HELOC, and you can Reverse Home loan

The essential difference between a property Guarantee Financing, HELOC, and you can Reverse Home loan

Important: PropStream will not offer financial guidance. This post is getting educational aim simply. Because your family can be utilized since collateral with many from such financing choices, we advice conversing with a monetary coach and/otherwise lawyer to be sure you will be making probably the most knowledgeable decision before shifting having any of these money possibilities.

Just like the a real house investor, you might be interested in creative an easy way to fund your next money spent or redesign a current that in the place of rescuing up a good higher deposit.

Are you aware that for individuals who already individual a home, you might be able to utilize its collateral of these intentions?

Overall, discover about three popular types of fund you to turn your residence equity on the bucks for an investment property: property guarantee mortgage, an excellent HELOC, and an opposing mortgage.

What’s a home Collateral Loan?

Since the term implies, a home security financing allows you to make use of your security to help you finance instructions. (Security is when far your home is value with no financial obligation you owe in it).

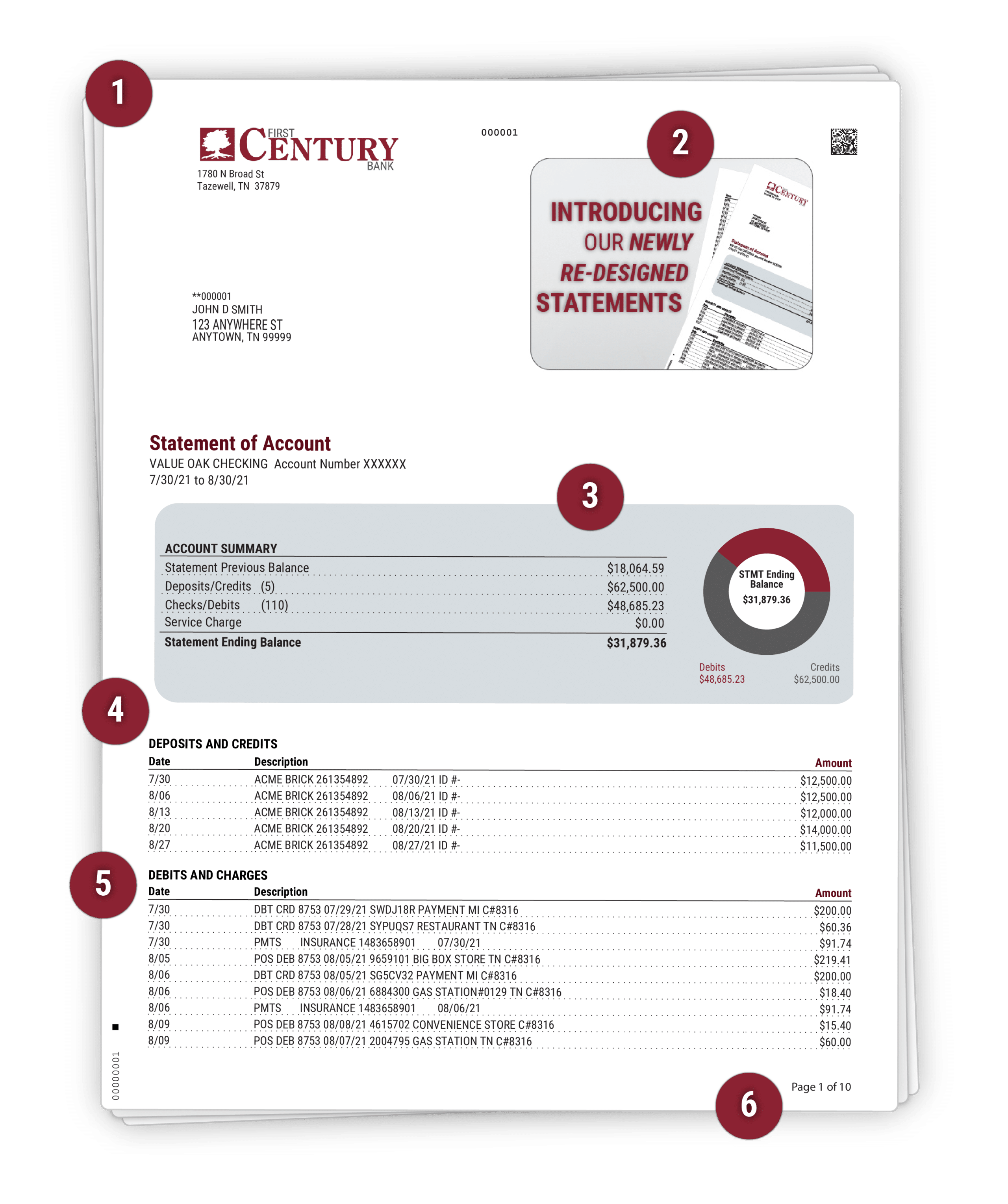

Family security funds are usually entitled second mortgage loans while they means much like an interest rate. Generally speaking, you receive the bucks as a lump sum and you may pay it off having appeal per month for a flat identity-normally out-of five so you’re able to 20 years otherwise stretched.

Like other mortgages, family equity finance often tend to be interest, things, charge, or other charges. Their attention pricing usually are repaired, and thus it sit an equivalent for the entire lifetime of the borrowed funds. Some investors prefer such mortgage by predictable monthly installments.

Extent you could borrow depends on their financial and your finances. However in general, the loan amount is typically simply for 85% of your own security you have got in your home. You’ll be able to use this currency to pay for private expenses, family renovations, or even the acquisition of your upcoming money spent.

Just remember that , your house will act as equity using this types of financing. Very, if you’re unable to pay off the loan, their bank might possibly foreclose on your property.

Home Guarantee Financing Requirements

Locate a house guarantee financing, your typically you desire at least 20% guarantee on your property and you may a debt-to-earnings ratio (your own full monthly obligations money separated by the total month-to-month money) of 43% otherwise less.

Lenders and look at the borrowing from the bank wellness. You will probably you would like a credit history of at least 680, according to the borrowing from the bank bureau Experian . Additional options are https://paydayloancolorado.net/san-luis/ for sale to individuals with straight down credit ratings, however these money fundamentally feature higher rates.

- You will get the borrowed funds since a lump sum.

- You could fundamentally simply borrow around 85% in your home guarantee.

- Rates and you will commission numbers is fixed.

- You should fulfill specific borrowing from the bank and you can earnings standards in order to meet the requirements.

What exactly is a HELOC?

Such property security loan, property security credit line (HELOC) allows you to utilize your own collateral to gain access to drinking water dollars.

However, unlike a house guarantee financing, an excellent HELOC really works a lot more like a credit card. In the place of finding the money just like the a lump sum, you obtain regarding the account since you need as much as an effective preapproved complete matter. It amount is based on their security, borrowing health, and you will bank. You then pay anything you obtain that have interest.

You could potentially remove funds from which account several times, but many HELOCs require that you take action contained in this a window of energy named a great draw months, hence typically persists on the four so you’re able to 10 years. Pursuing the mark months is over, you may be in a position to renew the fresh new credit line in order to continue using it.