Your credit rating shall be a button pro in your financial trip

Your credit rating shall be a button pro in your financial trip

- The Borrowing: Beginning several the fresh borrowing from the bank profile within the a short period could make you appear desperate for dollars, that’s a warning sign getting lenders.

How does My Credit history Number?

It will connect with your capability to track down financing having a good vehicles, get a house, or sometimes even homes a position. A beneficial score will save you several thousand dollars within the appeal along side longevity of financing. Therefore, it is worth hearing and you can caring such as a flaccid houseplant.

Consider, its never ever too late to begin with enhancing your credit score. Shell out your expenses promptly, keep the https://paydayloancolorado.net/derby/ bank card stability lower, and simply submit an application for new borrowing from the bank when necessary. The next self-will thanks a lot, believe me.

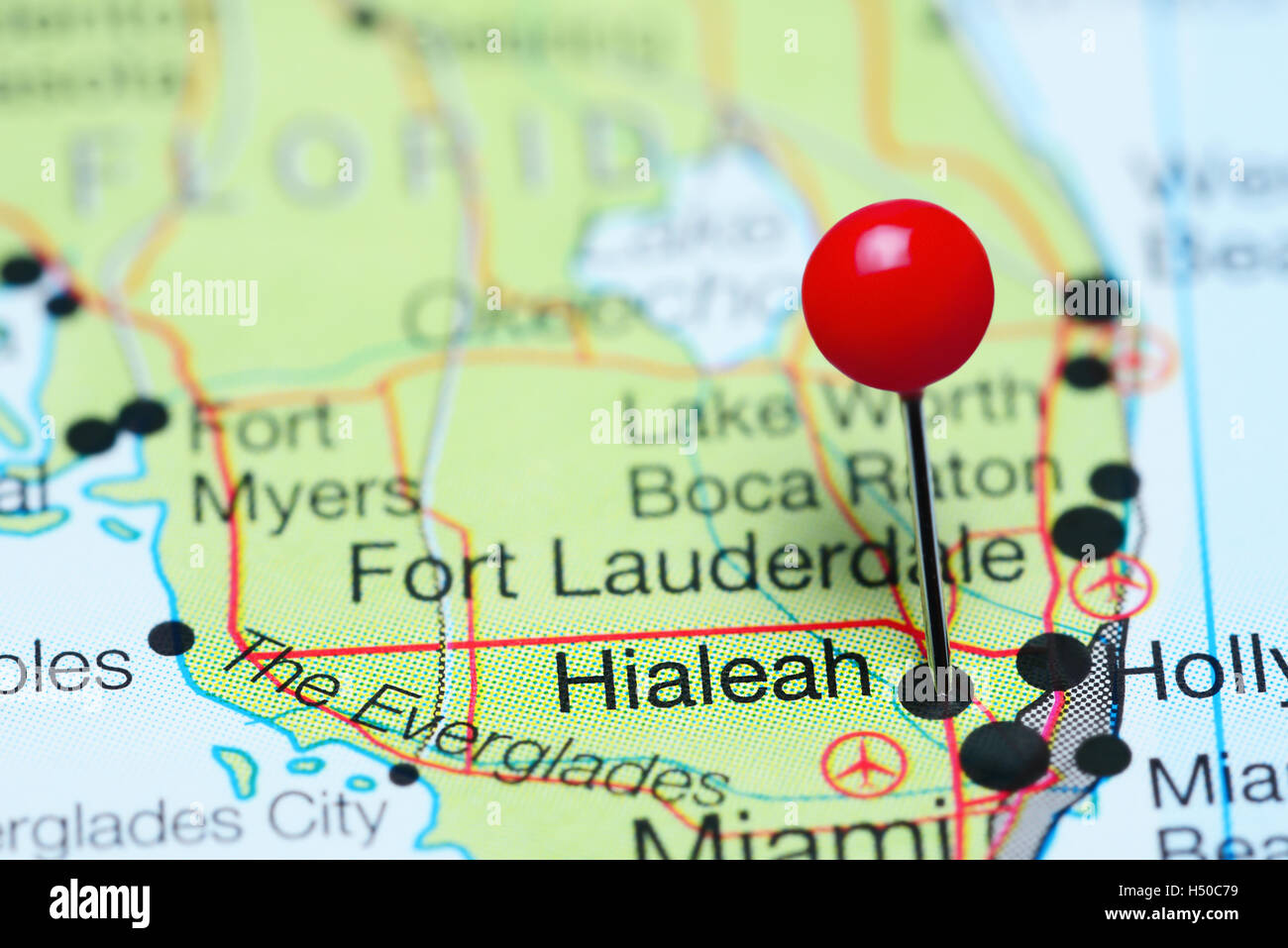

Possessions Kind of and you may Area

The type of property you may be eyeing can also be determine the required off payment. Including, when you find yourself eyeing a house inside a special society that have a higher income tax speed, your lender you are going to demand a more impressive down-payment. Similarly, if you are considering an apartment which have significant monthly HOA charge, your lender will need one to under consideration. Although many properties would not replace your financing terminology, it makes sense to see the lender so you’re able to explain or no specific functions might feeling the loan conditions.

You might have read the old saying that you should set down 20% to get a house. When you’re that may had been the newest fantastic rule once through to a beneficial day, the present the truth is a tad bit more flexible. Why don’t we dive on whether you should conserve you to hefty 20% down payment to discover the secrets to the new lay.

The new Myth off 20% Down

To begin with, the fresh new 20% advance payment recommendations is due to the very thought of to stop Individual Home loan Insurance (PMI). PMI are an extra fee you pay towards the top of their mortgage whether your advance payment try less than 20%. It is generally a safety net for lenders, however it can truly add a critical amount with the monthly premiums.

PMI usually selections out-of 0.3% to one.5% of the brand spanking new loan amount per year. So it assortment can be convert to help you a life threatening month-to-month rates depending on how big is your loan. Such as:

Toward an excellent $350,000 loan, in the event your PMI price is actually step one%, you are investing approximately $3,five hundred per year, or about $308 four weeks, in PMI superior. Placing 20% down on a house will normally clean out so it commission, this is why the majority of people discuss which percentage whenever revealing off repayments.

But here’s the kicker you never usually must set out 20% to purchase a property. Loads of financing apps are created to let very first-big date homebuyers or individuals who can’t afford a massive down payment. FHA loans, as an example, may go as little as step 3.5% down for those who have a significant credit score. And if you are a veteran, Va finance may not need a down payment anyway!

From the to shop for my very first home; the thought of preserving upwards 20% decided climbing Attach Everest. Rather, I plumped for a loan one greeting a smaller sized advance payment, and therefore created I will purchase my personal domestic at some point. Sure, I got to spend a bit more every month getting PMI, however it was worth your while first off strengthening guarantee inside my very own household. We marketed that household many years later making extreme money on it. The money I made try worthy of expenses some extra having my home loan.

Therefore, was 20% off expected? Not at all. When you are to prevent PMI and having a great deal more guarantee from the score-wade is superb, it is really not the only method in order to homeownership. Mention the choices, correspond with lenders on what finance appear, and do not allow the myth away from 20% stop you from searching for your perfect regarding home ownership.