Is an assessment mandatory getting a great Va loan?

Is an assessment mandatory getting a great Va loan?

- Va appraisal demand in the area

- Availability of accredited local appraisers

- Challenge accessing the home

- Unanticipated environment and other incidents

- Shortage of equivalent sales in your community

- Communication problems with realtors

Frequently, waits you to definitely happen adopting the property might have been checked was due to the fact we need to verify comparables (comparable property transformation called comps), Boizot says. Particular Real estate professionals that we need to call and you https://paydayloancolorado.net/nunn/ can be sure transformation having commonly precisely quick to name right back appraisers that have specifics on this new comps you to definitely we’re playing with. If they don’t get to me personally for 24-a couple of days, that can easily be an enormous cause for a delayed.

To minimize delays throughout the Virtual assistant appraisal process, begin by searching for a lender regularly Virtual assistant loans. More have the lender keeps on the Va procedure and you may conditions, the brand new less likely you are to tackle a defer.

On top of that, verify every needed property data is available and you will accurate, and continue maintaining open lines regarding interaction along with events involved in the home-purchasing processes.

Price tip having sellers and you may customers

Within the a great re-finance condition – and this would connect with whichever mortgage, not only particular in order to Virtual assistant – once you learn that appraiser is coming to-do this new examination on your household the next day, attain a summary of any standing and building work, Boizot suggests. This can be anything that you have completed to your property into the the very last ten to fifteen years, or at least the fresh new cycle that you’ve been in your house. Even if you can be remember just how much you spent.

Boizot offers this situation: For those who spent $3,000 color both bedrooms as well as the higher quantity of the latest family just last year (are specific), creating one upon a great, to the level checklist in what you complete and just how much it can cost you is actually indispensable into appraiser.

We fundamentally ask for [home] advice in the listing broker, Boizot states. Nevertheless client normally useful in expediting the procedure of going all of us all the information that individuals you want for the a buy scenario.

Yes, an assessment try necessary for a beneficial Virtual assistant mortgage. They serves to evaluate the new property’s value and make certain they meets the protection, coverage, and you may architectural stability criteria put of the Department away from Experts Affairs. These types of conditions is actually formerly known as Minimum Property Standards (MPRs).

Which pays for a good Virtual assistant appraisal, of course, if?

The buyer is normally accountable for purchasing the newest Virtual assistant assessment during the time of provider. It pricing must be protected through to the loan approval and you will closing techniques can be just do it. In some cases, a buyer can get negotiate for the vendor to pay for it costs.

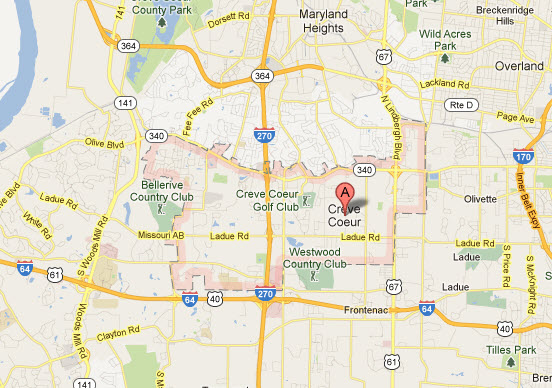

The expense of a great Va appraisal varies by the venue but usually selections from $375 to help you $550 or more. The actual payment relies on the new complexity of one’s assessment, how big is our house, additionally the geographical location of the property.

How much time are a great Virtual assistant appraisal legitimate?

A good Virtual assistant assessment is valid having 180 days about day regarding conclusion. So it authenticity several months is intended to cover the size of really loan processing timelines, both for the purchase money and you will refinance funds.

How much Will be your Family Worth Today?

Home prices keeps easily improved nowadays. Simply how much is your most recent home value now? Score a ballpark imagine from HomeLight’s free Domestic Well worth Estimator.

‘s the Virtual assistant assessment also a house examination?

Zero, a Virtual assistant appraisal is not necessarily the just like a home inspection. This new assessment analyzes the property’s market price and you can monitors to have minimal possessions standards according to Va guidance. They’re coverage, structural stability, and you will cleanliness criteria, such as for instance functional heat, electronic, and you will plumbing system systems; safe and easy accessibility; and you may versatility from health hazards.