Signing the Marketing and you may Import regarding Ownership

Signing the Marketing and you may Import regarding Ownership

Closing the offer

Done well! You’ve made it towards finally action of purchasing their cellular home with less than perfect credit: closing the offer. This is how you are able to finish the latest product sales and you may import control from your house to you personally. Here is what you have to know:

Knowledge Settlement costs and you may Costs

Closing costs could be the charges on the finalizing the purchase off your cellular home. These types of costs may include things such as name research charges, appraisal costs, and you may lawyer costs. Settlement costs can differ according to lender plus the county you are in, even so they normally may include dos% to help you 5% of price of the house.

It is vital to know very well what closing costs you will end up responsible for and just how far they’ll certainly be prior to signing to your dotted range. You can discuss into the supplier to see if they’re happy to cover a number of the closing costs, but expect you’ll shell out about a few of them on your own.

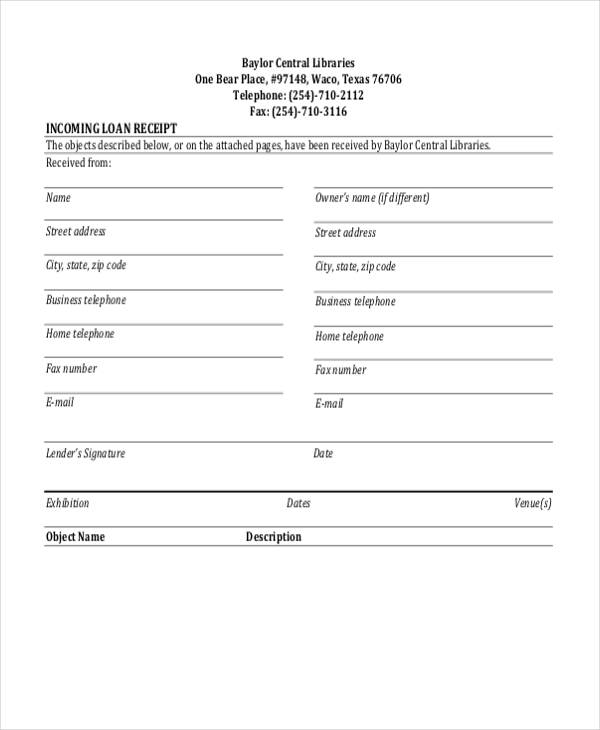

After you’ve agreed on the price and you may people contingencies have started came across, it’s time to conduct the brand new sale and you may transfer possession of your the place to find you. This really is usually done during the an ending appointment, where the people involved in the business usually signal the desired paperwork.

Within the closure meeting, you’ll want to pay any kept settlement costs together with down commission into home. You’ll also must signal the loan data and every other paperwork necessary for their bank.

After all paperwork could have been signed therefore the financing has actually already been moved, possible officially get to be the proprietor of your mobile domestic. Done well!

It’s important to note that if you find yourself financial support your mobile household, the financial institution will likely lay a great lien on the house up to the loan was paid off. Consequently for those who default with the loan, the lending company normally repossess our home.

In summary, closing the deal for the a mobile home with bad credit can be getting a little more challenging than simply a classic home buy. Although not, from the understanding the closing costs and you may fees and you may signing the new income and you will transfer out of possession, you’ll end up on your way to help you to get a mobile homeowner.

Done well for the purchasing your cellular household! Now that you have the set, it is very important consider several things in order for their financial support lasts very long.

Setting up a permanent Foundation

One of the primary anything you need to thought try form up a permanent foundation to suit your cellular family. This will not only make your home better, nevertheless also increase the value. You might select different types of fundamentals, also a tangible slab, piers, or a cellar. Before carefully deciding, be sure to check with your cellular home park otherwise are built household people to see if there are people certain criteria.

Maintenance and you can Domestic Warranties

As with any almost every other family, a mobile domestic needs typical maintenance to keep it from inside the a great condition. Including things like tidy up gutters, examining to own leakages, and you can replacement filter systems. Also, it is best if you purchase property promise to cover one unforeseen fixes. A lot of companies give warranties specifically for cellular homes, thus make sure you do your homework and get the one that fits your needs and you can finances.

Along with these types of factors, it is essential to keep in mind one certain laws and regulations otherwise laws and regulations set by the cellular household playground or area. Particular areas may have limitations to the things like land otherwise additional improvement, so make sure to see prior to making people transform. If you take such actions, you could make sure your cellular family stays a smooth and you will safer spot to real time for years to come.

When you yourself have poor credit, you may find it hard to find recognized for a loan or if you tends to be given a higher interest. Ergo, it is very important understand your credit rating before you apply for that loan.

Another option to consider is a beneficial Va mortgage. Va money are supported by the Institution away from Experts Affairs and are available to experts and you will productive-responsibility armed forces people. For individuals who be eligible for an effective Virtual assistant financing, you might be able to purchase a cellular home with no advance payment.

Credit Unions and private Loans

While preparing to order a mobile house or apartment with poor credit, you will need to do your research and stay waiting. Imagine to shop for a used mobile family and you may negotiate which have cellular house investors to ensure that you get the best price you are able to. By using these loan places Hartford types of actions, you could make the entire process of to purchase a mobile home with bad credit smoother and reasonable.