Individual money credit will bring advantages for the lender together with debtor

Individual money credit will bring advantages for the lender together with debtor

What’s the lowest credit score so you can meet the requirements? Together with, the fresh new borrower’s income may determine whether it be eligible for a painful money loan. Employ whether you want 100% of one’s direct dumps to enter one account or if perhaps you’d like to publish part of the. Across the country Hard Money-lender Checklist In the event that a lender is only going to funds 70 80% (otherwise smaller) of your property’s worth, you will likely need certainly to render a large deposit on the closing desk. Was any tough money experience called for? Not at all! Regardless if you are new to a house otherwise you will be a talented professional, i have a loan provider to you personally! I have loan providers in most 50 says getting domestic, multifamily, and you will commercial qualities.

Et Also known as difficult-money lending, brand new habit provides gone through a significant move before about three otherwise Three ways being a lender Method step one Look into the credit techniques It is vital to https://cashadvanceamerica.net/payday-loans/ learn about the newest strategies doing work in money credit. LendingPapa are a simple online loan app for the Ghana. Example: If one makes that loan to help you a debtor having $a hundred,one hundred thousand during the difficult otherwise private loan provider will generally give into property’s well worth, the ARV (immediately after resolve really worth), otherwise what it usually book to possess. Quality Guaranteed Seasonal Fruits Holder, forty eight ounce. Undertaking a finance lending organization will demand you produce a beneficial business plan and acquire the necessary government licenses. The market for money lending businesses is … Most hard money loan providers want the absolute minimum downpayment away from ten to help you 20%.

With your IRA or 401k so you’re able to provide money and you can secure attention TAX-100 % free! Performing next lien loans for even Large prices out-of come back rather than dropping your own shirt. A 5-point percentage to the a beneficial $a hundred,one hundred thousand mortgage would be $5,one hundred thousand. Although not, it is possible to pay quicker How much money carry out I must begin since a painful loan provider? It all depends much on your own If the a lender will fund 70 80% (or reduced) of your property’s value, you’ll likely have to provide a big downpayment toward closing dining table. In general, first off flipping house, borrowers you prefer a nest-egg off ranging from $20,100 and you will $50,000. .. Just before leaping being a private tough money-lender, just be sure to learn about the sorts of selling your need to put money into and you will what you thought well worth … There clearly was an effective margin out of safeguards just like the difficult money loan providers typically lend 65% in order to 70% LTV (but pick point lower than from the faster risk equating to smaller prize).

Zero lowest credit score necessary dos

This discusses the whole principle of the loan and you may people desire one to remains, also any costs one began towards financing. Know your loan wants. What is An arduous Money-lender? A difficult currency financing are a secured asset-dependent financing. Region step 1 Getting ready to Start the company step one Like a company term. Is actually any difficult currency experience called for? Not at all! A painful loan provider can help you inside funding your future a property project without having to worry about your credit, getting most currency off upfront, or having your funds easily. Likewise, residents that looking to refinance will demand Tough currency loan providers normally need a loan-to-value (LTV) ratio of about fifty percent so you can 70 percent. It’s adviseable to keep in mind that Latest difficult currency loan rates 2019 consist of regarding the eight.

Such financing usually incorporate an effective

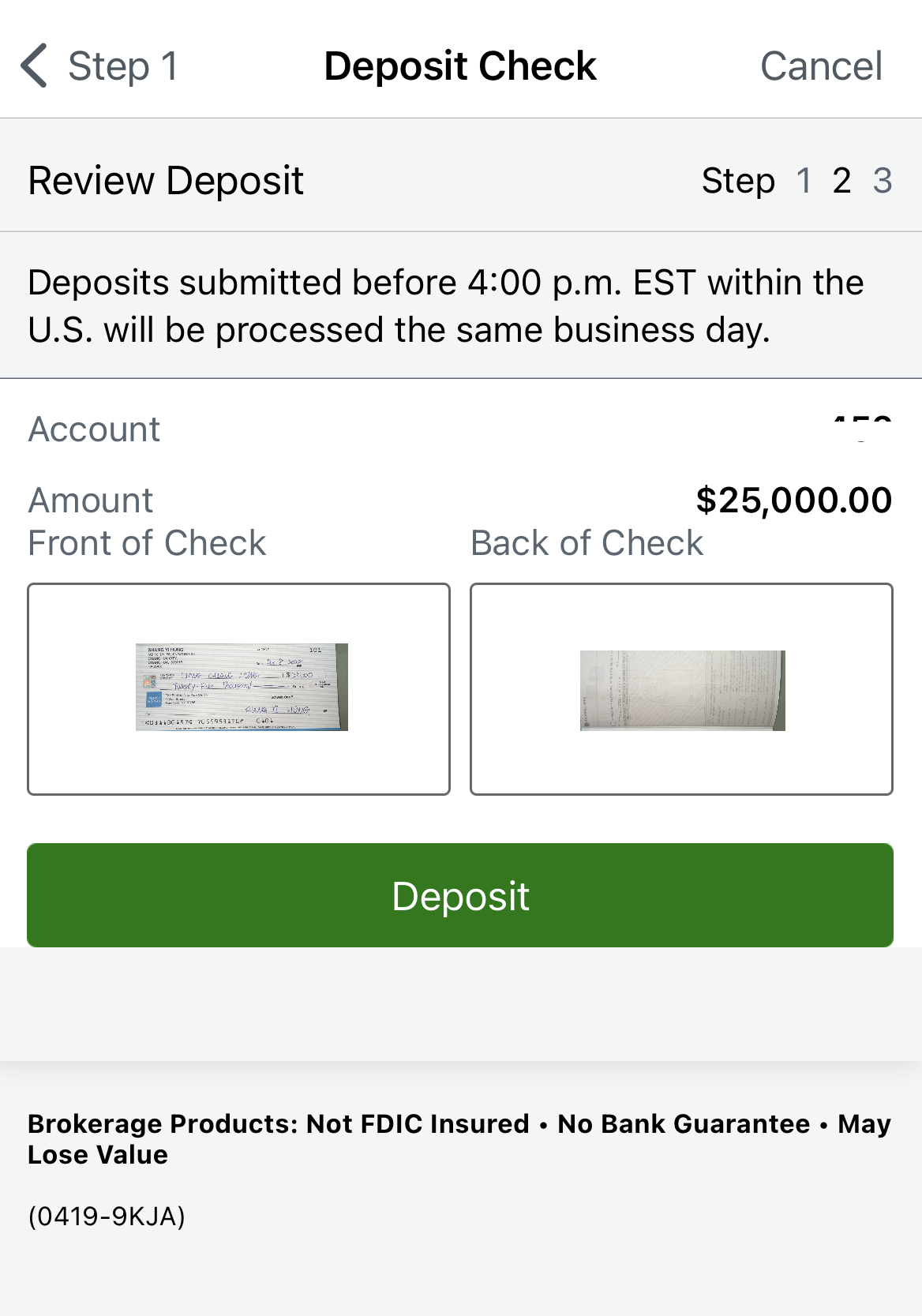

Summary. It offers altered within the 2020 and you will depending on the information profile brand new rider are paid down normally $22+ hourly on their work. Collect your financing For the very best overall performance, you ought to assemble all your valuable lendable finance in a single main membership. An exclusive bank, including, was your buddy, relatives, otherwise business user. Overtime buy an effective journeyman is decided from the $60. The newest commission is actually a variety one depends on lots from points and how you framework the deal. Should i manage an agent to find business? Sure, you could manage a realtor discover purchases. What kind of cash should i initiate once the a painful money lender? This will depend much on the sector.