Benefits and drawbacks out-of settling their financial very early

Benefits and drawbacks out-of settling their financial very early

The choice to repay your mortgage early is problematic. The option you make could affect anything from cash flow to prospective resource potential therefore the respond to vary for all. We consulted Aseem Agarwal, Head away from Mortgages at the Around the world Funds to your positives and negatives from paying down your home loan before schedule. Listed here are a few of his information.

Professionals regarding paying down your own mortgage early

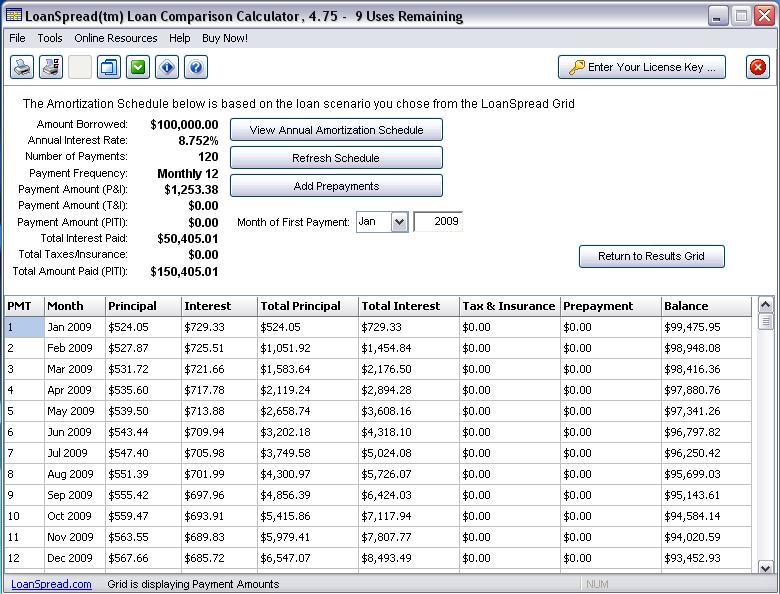

Making a lot more mortgage payments is also result in nice notice offers over the life of the mortgage. For every single more payment towards your principal means less money spent on attract. a smart circulate for long-name coupons, Aseem Agarwal demonstrates to you.

For those who have a smaller mortgage, youre hit shorter hard on the wallet while in the tough times whenever rates is actually large; the fresh new impression interesting hikes is not so good.

Paying down their financial you are going to free up big chunk of money in brand new old age that may be rerouted with the most other monetary requires, including investing, knowledge, or old-age.

Additionally, it form you can make use of the newest equity on your latest assets with other objectives, for example offered a business purchase, to find another domestic or building a house profile.

Complete and you can home loan free control of your property brings a sense off security and you can assurance. The fresh new freedom out of with home financing clinging over your face can also be getting a strong motivator and you can financial safety provider notes Aseem Agarwal.

Disadvantages away from paying off your own financial early

In case your home loan rates is https://cashadvancecompass.com/payday-loans-nh/ lower than what you’ll secure into a decreased-chance funding with the same name, you may want to support the financial and you will invest any additional you could. Aseem Agarwal ways studying the mediocre financial rate of interest versus potential yields away from risk free otherwise lower exposure purchasing. This is certainly specifically relevant for people who safeguarded a reduced home loan rate in advance of recent interest rate rises.

You have got repaid your home loan, but that does not always be sure you can access those funds once more. Then it on account of alterations in your needs, financial financing requirements or home philosophy. For example, possibly your own a job changed, otherwise family cost has actually dropped and this your own collateral has shrunk.

Aseem elaborates: Can you imagine We paid down $100,000 away from my personal home loan convinced that I could withdraw they later on due to the fact We have got $100,000 away from even more guarantee in my home. But probably the field have fell, therefore the value of our house moved off of the $100,000. Maybe We have moved regarding being a member of staff in order to being thinking-working, thus i will not be eligible for financing within the bank’s credit standards. I might not be able to withdraw that cash once more. It may have been a whole lot more good for had the money sitting in the a bank account in the six% or in a counterbalance home loan contrary to the loan; I could then possess removed onto it any time.

He explains next: The decision ranging from paying their financial early and you will expenses would depend on your risk endurance and you will capital approach. Buyers with more autonomy plus money might believe there’s an opportunity for highest yields, but since Aseem alerts, it is best to bear in mind that riskier or more volatile opportunities change, and better efficiency is actually certainly not protected.

Particular lenders enforce prepayment penalties for individuals who settle your own financial early. Because Aseem tells us, Only a few loan providers fees it fee, however should pose a question to your financial earliest.

Proper factors

Before carefully deciding to settle their financial early, it is an excellent tip having a clear plan towards additional money. Aseem Agarwal suggests, If you’re paying your own home loan very early so you can enjoys more funds flow once repaying their real estate loan , you really should have an idea away from exactly how you will employ or purchase one to additional money. The very last thing you are doing need that cash is sitting sluggish within the a bank account and receiving zero otherwise reduced get back. With rising prices, the worth of that cash just reduces. With these extra fund to store appeal in your financial can also be end up being a far greater approach.

For many individuals, paying down the borrowed funds and you will retiring loans-totally free music pretty enticing. It will imply less care and you can enhanced self-reliance. In the event the home loan repayments represent a substantial amount of the expenses, you are able to live on a lot more shortly after you to percentage disappears.

When you are looking to stay-in your family through the old age, eliminating monthly installments would-be a flow. However, for the majority of people, their financial situation and you will goals you are going to mean it is prudent so you’re able to manage other priorities whenever you are chipping away from the their house financing.

Paying your own mortgage early is a vital monetary choice. It will require careful consideration of the items, monetary desires, risk endurance, and complete monetary fitness. Aseem emphasises the need for a proper tailored approach. You could even think a plan where you are able to each other dedicate and you may pay down the main mortgage, Aseem states. It’s not necessary to generate an all-or-little decision.

By consider the huge benefits and you can drawbacks, understanding the possible influences and consulting with fiscal experts like the people from the Global Funds, you possibly can make a knowledgeable decision one aligns along with your long-label monetary specifications. We will make it easier to know the choices, so e mail us to generally share your mortgage today towards the 09 255 5500 otherwise

The information and you can content penned is true to the better of the global Financing Features Ltd education. Just like the advice offered in this blog try out of standard character and is maybe not intended to be personalized economic recommendations. We prompt you to definitely search Monetary guidance which is customized situated on your own need, goals, and you will facts prior to making any monetary decision. Nobody otherwise persons which depend in person otherwise ultimately up on advice within this article can get hold All over the world Economic Functions Ltd or the team responsible.