Borrowing from the bank is a vital element of the borrowed funds mortgage certification techniques

Borrowing from the bank is a vital element of the borrowed funds mortgage certification techniques

What You will see

Their high school mathematics kinds most likely trained pi in addition to quadratic equation. (Would you explore those people today? None do we!) As an alternative, we need to have focused on a very essential number: your credit score.

Their get stands for your capability to cope with personal debt and assists dictate your interest rate. The reduced the interest rate, the lower their monthly payments would be.

You actually have around three credit ratings, depending of the around three big credit agencies: Equifax, TransUnion, and you may Experian. Using a system named FICO A rating design you to definitely measures credit risk. FICO A rating design that measures credit risk. , each agency explores your debt records and you may assigns your a variety from 3 hundred (very low) to help you 850 (exceptional). For more information on this type of results, go to all of our Training Heart article, Building Your Credit 101.

For each agency ratings your a small differently, nevertheless the minimum assortment need for some mortgage apps was ranging from 580 and you will 640. Why don’t we look closer on credit ratings as well as their requirements.

To start with Reasonable, Isaac and you may Business, FICO is a document statistics providers based in San Jose, Calif., created by Expenses Fair and Earl Isaac inside the 1956. The FICO score was the leading way of measuring credit risk, while the one primarily employed by lenders.

The manner in which you Was Scored

Undoubtedly, the very first action you can take https://paydayloanalabama.com/castleberry/ in maintaining a good credit score is to build your payments promptly. Later payments can decrease your credit score, and significant delinquencies, such as for example collections, normally stay on your credit history getting 7 many years. Find out more about delinquencies and how it connect with your own borrowing in all of our Degree Cardiovascular system post, Exactly how Delinquencies May affect Your credit history.

Mortgage Program Credit rating Requirements

Really funds fall into among following five kinds. Authorities loans enjoys particular service guidelines that loan providers need to stick to, but eventually, the financial institution identifies the minimum score they’re going to take on.

Traditional funds are usually to own individuals with more powerful credit, strong earnings, and discounts to possess a downpayment. The financial institution by yourself sets the credit criteria. Atlantic Bay’s minimum credit history requisite try 620.

Federal Houses Government (FHA) loans try federally covered mortgage loans to have consumers with all the way down fico scores and money. Once you learn your fico scores need really works, such loans would be a good idea to you. Brand new FHA’s minimum credit history criteria was 580; Atlantic Bay need 600.

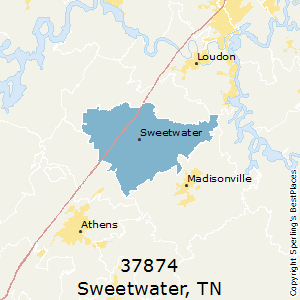

U.S. Agencies out-of Farming (USDA) loans was authorities-recognized mortgage loans getting down-earnings homebuyers for the components fulfilling certain inhabitants requirements (Fun truth: You don’t have to be a character!) The latest USDA doesn’t always have a fixed credit rating requirement, however, 580 is the sheer minimum. Extremely lenders wanted an effective 640 to own USDA finance. Atlantic Bay, however, just needs 620.

U.S. Agency out-of Experts Circumstances (VA) financing try bodies-supported mortgage loans for army pros, solution members, and you will enduring partners. The fresh Virtual assistant doesn’t always have the very least credit rating needs, however, once again, you want at the very least 580. Atlantic Bay’s minimum is actually 600.

Imagine if We have Less than perfect credit?

Basic, phone call your financial. In the Atlantic Bay, our Mortgage Bankers are content to-do good silky remove A review of your credit report that’s not associated with people lending choices. flaccid eliminate A glance at your credit report that is not linked with any lending behavior. on the borrowing from the bank (where your own fico scores may not be affected) and check out an effective way to reduce levels and you can care for delinquencies. You have got additional options, eg beginning a secured bank card, or becoming a 3rd party representative to possess someone you care about which have solid credit. We shall support you in finding aside!

An excellent “silky pull is actually a look at their borrowing from the bank that isn’t associated with people credit ple, an apartment cutting-edge, insurance carrier, if not you yourself can do a smooth eliminate simply to test thoroughly your credit. Flaccid draws dont connect with your credit score in any way.

It’s also advisable to display your credit score to really have the large credit history you can and become safe from identity theft & fraud. You really have you to definitely out of for every single borrowing from the bank agency, and you are clearly entitled to a no cost credit report out of for each of those yearly. You can see all of them by going to AnnualCreditReport.

Occasionally, you might join the assistance of a card fix providers. You will find a reputable department to your Service out of Justice’s a number of borrowing guidance organizations. Remember that rebuilding takes some time, possibly ages. And you will even with every one of these free borrowing repair adverts, credible enterprises tend to charges charge, starting about out-of $20 to help you $130 a month. On the bright side, a lot of companies provide discounts having veterans, partners, and you may older people, as well as money-back promises.

Borrowing Karma compared to. FICO

In the end, all of our Home loan Bankers usually are requested, What makes my credit rating along with you distinct from Borrowing Karma? Services such as for example Borrowing Karma tend to give you other results than just those individuals available with FICO. This is because Borrowing Karma spends a different sort of scoring design-VantageScore. But not, extremely lenders, as well as Atlantic Bay, fool around with FICO, very this is the one to you will want to see.

Whether your borrowing from the bank actually the place you want it to be, usually do not anxiety. Over the years and perseverance, there are methods send, in addition to Atlantic Bay class is ready to help you!