Can Someone Score Signature loans no Income Verification?

Can Someone Score Signature loans no Income Verification?

You can get a consumer loan and no money verification. However, it can be difficult to qualify for one because most lenders wanted a constant money to help you safe an unsecured loan. On the other hand, it might not be a good notion to place your monetary wellness at risk if you fail to afford to pay-off the mortgage.

Thankfully for gig cost savings professionals with changing earnings, some loan providers will let you make an application for that loan and no earnings or let you use non-a position money. Prior to your sign up for you to, it is very important shop around and you can think about the positives and you can drawbacks of getting a loan instead of a constant money.

So what can You expect After you Sign up for Funds In the place of Earnings Take a look at

The method while the conditions are very different when obtaining good unsecured loan to have notice-employed no evidence of earnings. In place of guaranteeing your earnings, the newest loan providers may look at your individual credit score.

To suit your loan providers, a good credit score means you really have a track record of spending financial obligations timely, making you less of a risk getting standard otherwise non-payment of the expense. Although this by yourself will not be sure loan recognition, a superb credit score things you on best guidelines.

For example, loan providers generally speaking charge lower rates for people who have an effective a good credit score listing. This enables one to reduce the debt repayment costs, which should be your goal when trying to get no income confirmation personal loans.

Besides looking at your credit rating, loan providers you will ask you to guarantee or at least present proof out of a secured item used given that guarantee, like your automobile or property. You need to demonstrate that you or perhaps the financial can liquidate it house on the dollars to repay your own financial obligation in case of a great standard. New downside out-of pledging equity when making an application for signature loans no income confirmation ‘s the likelihood of losing you to resource should you don’t pay the borrowed funds.

Oftentimes, lenders should include themselves from the asking so you’re able to appoint a beneficial guarantor otherwise co-signer on loan. Which guarantor is to ideally be somebody who will expose a reliable earnings. Just like guarantee, requiring a candidate in order to designate a beneficial co-signer covers the loan providers regarding financial losings. If you default, they are going to follow their co-signer alternatively.

Certain lenders are also ready to assist people who have no income and you can an excellent credit rating borrow money. However, this new wide variety readily available try significantly less than the individuals available to people with steady income and you can a good credit score ratings. Loan providers also can charges very high interest levels in order to counterbalance the chance.

Last but not least, lenders you may require proof of solution income aside from your primary concert. These include Public Security masters while resigned, dividends from your investment, and you will public assistance fund, and others.

Preparing to Sign up for Money And no Income Verification

For mind-operating anybody, it is simply a matter of big date up until the need look for investment pops up. Because you manage your organization, you could soon find openings which make it hard for you to repay electricity repayments, equipment repair, and you can personnel payroll for individuals who get work.

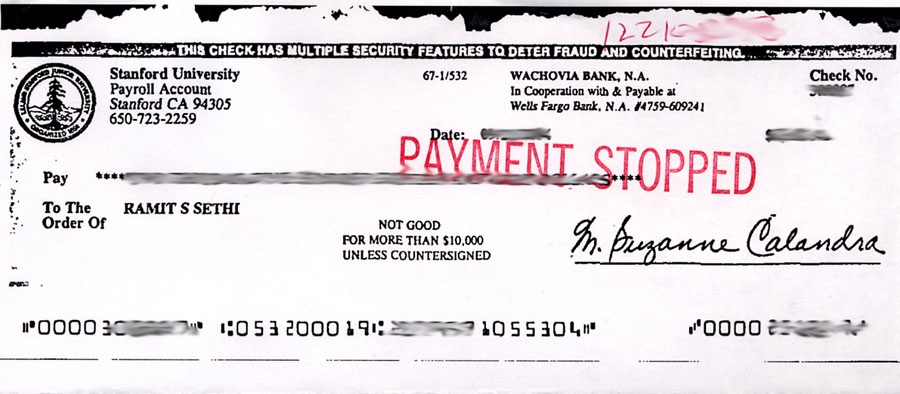

You need to be able to find debt statements manageable before you even need certainly to borrow cash. Yours financial comments offers potential lenders that have proof of regular or, about, recurring earnings. Gather suggestions of money comments and cash disperse that go back at the least three months. This is certainly and additionally the opportunity to evaluate should your organization is indeed in good shape or not.

You could potentially demand a copy of your credit rating and you will rating out-of all around three credit agencies to own a fee. Utilize the guidance be effective into improving your credit score. You could start because of the repaying one or more or a couple of your existing money on time whenever you can. You may want to choose mistakes on account, so you’re able to fix them while increasing your credit rating.

When it’s time to sign up for a consumer loan and no money confirmation, you might been employed by at while making your credit rating all the way to you can easily.

Before applying, you will also need certainly to select a secured item that you might hope once the guarantee when requisite. An elementary choice is the house mortgage or perhaps the house in itself. not, you and your spouse must’ve produced tall repayments into the home’s security before you could borrow against the borrowed https://paydayloanflorida.net/south-palm-beach/ funds. Other viable choices range from the title on your automobile, if it has been totally paid back or is perhaps not made use of since security in another loan.

Solution Types of Finance Getting Money without Money Verification

- $five-hundred to help you $5000 money

On line credit systems promote unsecured loans so you can gig discount specialists exactly who secure 1099 earnings. You can aquire quick access to money for approximately $5000, which can be used to enhance your business. Bank conditions are different, but you should be thinking-operating and have a work reputation for no less than three months that have monthly earnings of more than $3000.

- Friends

One of the ways you can buy financing as opposed to earnings verification is through asking your friends and relatives for just one. One which just borrow the money, make sure to put the new terms and conditions of the loan. When you find yourself these deals might not involve an agreement, you might want to err sideways of warning and you will draft a proper bargain to safeguard the newest appeal of one another events. New contract should description the newest fees procedure, plan, and you can interest.

That it choice type of money takes into account your earnings background and you can charges you only a certain portion of their revenues since fees. This is similar to a supplier payday loan it is perhaps not simply for mastercard transactions only. Loan providers will learn your banking comments, ount it can allow you to borrow, and auto-debit your payments from your own savings account every month if you do not totally spend the money for mortgage.

Summary

You can buy a personal bank loan no earnings confirmation, however may have to take on higher interest levels, new pledging from security, and you may a very stringent procedure.

As well, self-employed people may want to believe solution forms of investment that none of them a good or a good credit score get. They are members of the family money, Automatic teller machine payday loans, crowdfunding, and many others. Such low-traditional money can be handy for the an economic crisis because the loans or other antique sourced elements of investment.