Exactly what are the Risks of Bridging Financing?

Exactly what are the Risks of Bridging Financing?

not, bridging finance include paid off within this a-year, making the installment label far reduced than just having home financing

- Developed quickly a connecting financing representative may help you organise finance inside a good few days, depending on the condition and you can complexity of loanparatively, a mortgage takes far stretched to help you manage as a result of the underwriting procedure, judge processions, and you can a lender’s inspections to generally meet their particular criteria such as for example credit rating, work and income, etc.

But not, connecting financing were repaid within per year, putting some payment label far shorter than simply having a home loan

- Flexible if the items is seemingly easy, a basic home loan with high highway bank will be the option for you. Yet not, when you yourself have more complicated points, brand new criteria out-of a premier path bank can get prove tight and you will rigid. Connection money are often just provided with private lenders, which will promote better flexibility with regards to need and aim.

not, connecting fund become reduced contained in this per year, deciding to make the repayment label far faster than just having home financing

- In many cases, a cheaper solution Bridging finance will often have high interest levels than simply mortgage loans, very mortgages usually tend getting the cheaper alternative. Yet not, due to the fact mortgages is actually spread out more than such as for instance a long period of big date, connecting fund may be able to end up being developed in the a beneficial probably less expensive than just a home loan. Also which, there aren’t any very early payment charges in case the loan try repaid sooner rather than later.

However, bridging loans tend to be paid down inside annually, making the repayment name much smaller than having a home loan

- Is going to be better to qualify for Requirements are reduced stringent, and connecting americash loans Julesburg loan providers may have looser requirements than mortgages. Yet not, loan providers may differ away from standards. One of the pro brokers will be able to chat you from terms of qualification before applying.

Although not, connecting funds become repaid within a-year, making the installment title much smaller than just which have a home loan

- Bridge finance give individuals the latest methods to work They’re able to provide you with the possibility to view loans quickly within the a competitive sector. Hence as opposed to that one makes it possible for you to secure an aspiration homes otherwise resource options that you may otherwise remove.

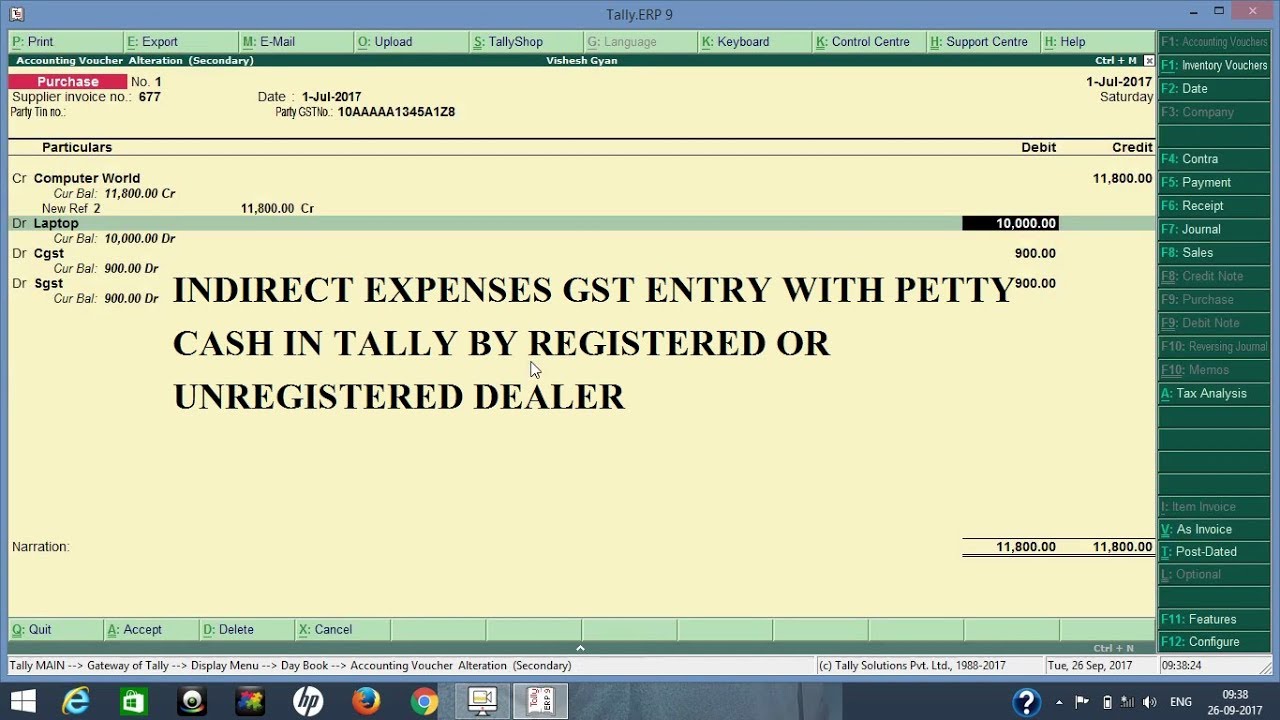

Check out the videos below discussing a guide to connecting financing and you can how they may be employed to loans a property buy:

With correct information and you can information at the outset, a link financing should be a much smoother provider with no riskier than just about any form of financing, given that all sorts of financing twist some number of exposure.

Yet not, bridging loans are paid back within this annually, putting some payment name much shorter than just that have home financing

- As a result of this it is necessary to keeps a definite hop out method when you apply for a bridging loan to display that you know the newest assented conditions and won’t struggle to expend straight back the loan inside assented timeframe.

- This is certainly even the important facet of connection funds. Lenders will determine if you could pay back the borrowed funds during your get-off approach, that will bring of a lot models.

- Attempting to sell your own dated house, turning and you can offering your home, or changing so you’re able to home financing are typical acceptable get off actions that are used daily.

- Oftentimes, this really is an important underpinning for the cost of your financing.

Into the proper suggestions which help, a bridge loan will likely be sensible. A professional broker can be verify you are on the best track and you may show you through the processes.

A professional loans agent which understands your circumstances can determine whether home financing otherwise bridging loan try ideal for both you and just how to discover the best you’ll bargain.

Case study Discover our very own recent example lower than on how we assisted all of our subscribers downsize to help you a retirement apartment from inside the Bristol

not, connecting financing are reduced within annually, putting some cost name much faster than just with a mortgage

- These types of will set you back tend to are in the form of highest desire pricing otherwise extra fees origination costs, valuation costs and underwriting charges, an such like. in fact it is a portion of your own full amount borrowed.