Given that Weather Chance Increases, Thus Will Prices for Smaller businesses

Given that Weather Chance Increases, Thus Will Prices for Smaller businesses

Given that weather chance rises, businesses of all the kinds need so you can put in far more of the spending plans so you’re able to preparing for and replying to disasters. Investing in chance management might help offset such will set you back, however, many enterprises, such as for example small businesses, may not have the fresh monetary freedom to get it done. When you look at the , the brand new people surveyed 273 businesses influenced by Hurricane Harvey (and you will assessed the credit records of five,000) after they struck Southeast Tx in 2017 observe the way they answered. With this specific investigation, the latest experts reveal the brand new enough time-title effects regarding calamities to have organizations, and you can express lessons to own policymakers and you may advertisers about how exactly best to set up organizations to have upcoming exposure.

To deal with broadening climate dangers, organizations would need to arranged an evergrowing display of the dollars circulates. Hurricanes, wildfires, additionally the increase in water profile impose can cost you with the enterprises, both in preparation and reaction to this type of disasters. Once the risks expand, those individuals prices are merely likely to raise throughout the years.

Chance government can help do away with the cost of weather transform. Strong risk management strategies covering resource products – insurance policies, booking, and you can credit – to address different aspects of risk. This encourages recuperation giving businesses money they require when emergency impacts.

But committing to chance government in addition to imposes instant can cost you. Insurance coverage need initial superior money. Bucks reserves need staying fund reserved to possess a wet go out. Browsing loans repairs that have borrowing need enterprises in order to maintain monetary independence – staying enough loose within finances to view that loan from inside the the future.

As a result, cash-secured businesses are unable to to improve. Business particularly tend to operate on slim margins, hustling to fund day-to-go out expenditures eg to shop for list or appointment payroll. Of numerous don’t getting they have the luxury so you’re able to dedicate info so you can chance management. However, without it, companies will get deal with even more demands which can build data recovery higher priced throughout the aftermath regarding a shock.

To understand more about these types of dynamics, i examined just how Hurricane Harvey affected businesses just after it strike The southern area of Texas inside the 2017. Harvey is the most expensive experiences – resulting in $125 million in economic injuries – from the most expensive emergency seasons with the U.S. in four many years. Environment boffins guess your violent storm was about 29% more serious on account of weather alter, it is therefore an example of the way the risks of significant storms try broadening.

The content

From inside the , about 1 year after Harvey, we interviewed 273 companies regarding the affected area – effectively regarding higher Houston to help you Corpus Christi towards Gulf coast of florida Shore. Surveyed enterprises was comparable in the age and you will proportions some other companies in the area. Our questionnaire requested outlined questions about any loss it sustained, how they purchased her or him, and exactly how their healing try progressing.

https://paydayloanalabama.com/newbern/

To suit the fresh survey, i examined the credit records around 5,one hundred thousand organizations throughout the disaster urban area and you will opposed their pointers to step 3,000 businesses throughout the new You.S. have been maybe not in Harvey’s street. Since the questionnaire has the benefit of an over-all sense of businesses’ experience and you may healing actions, credit file provide metrics widely used because of the lenders, landlords, supply chain couples, while some to assess the new company’s financial health eg whether it pays its debts promptly.

What Did Enterprises Reduce?

Our very own questionnaire requested participants questions regarding their loss off Harvey. Enterprises said many different difficulties, nevertheless the very hitting was in fact money losings. Nearly ninety% off interviewed companies stated shedding revenue due to Harvey, most frequently about five-shape range. This type of money losings was indeed due to worker interruptions, all the way down customer request, electric outages, and/otherwise supply strings activities.

A lot fewer companies (about 40%) educated possessions harm to its strengthening, machinery, and/or collection. When you find yourself less common, possessions damage losses had been higher priced an average of than simply destroyed money. Yet not, assets wreck compounded the issue away from lost funds by continuing to keep the providers closed: 27% having assets destroy closed for more than a month, and you can 17% closed for over three months. Because of this, revenue loss was basically regarding two times as large for businesses which knowledgeable possessions ruin.

Businesses’ credit reports once Harvey reveal signs and symptoms of stress as well. Harvey caused of a lot enterprises to-fall at the rear of to their financial obligation payments. Regarding terrible-flooded portion, the new violent storm increased delinquent balances from the 86% versus the pre-Harvey profile. This feeling is certainly caused by restricted to reduced-title delinquencies (under 90 days later); we do not find a significant upsurge in loan defaults otherwise bankruptcies. That it trend almost certainly reflects businesses’ large work to end defaulting for the their bills.

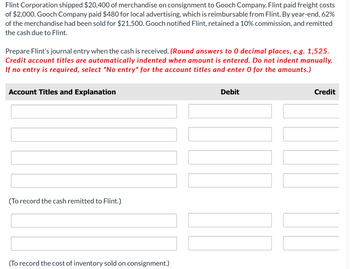

How Performed Enterprises Manage Money and you can Possessions Losses?

A thorough chance administration strategy traditionally spends insurance rates so you’re able to transfer major dangers such as for example hurricane-related possessions damages. But insurance rates doesn’t protection specific loss – also funds losings because of lower consult, personnel interruptions, and provide strings things. Credit contact modest-severity loss; dollars reserves target short-size losings. This layering try priple, holding higher cash reserves keeps an enormous opportunity costs. What’s more, it needs right up-top planning and you may financial diligence.

It layered risk government means – insuring the top dangers, borrowing toward moderate, and ultizing dollars with the brief – is not a good number of companies did. Merely fifteen% regarding surveyed agencies impacted by that it listing-cracking hurricane acquired a payment out of insurance. So it lowest insurance rates stems from companies being uninsured for flood and you will snap problems (elizabeth.grams., they’d insurance policies one omitted visibility for those risks) and/or businesses guaranteeing their residence but not their cash exposures.

Borrowing from the bank also played a tiny role: 27% off surveyed providers put credit to finance recovery. Enterprises often hadn’t managed enough financial autonomy so you’re able to obtain just after this new crisis, given that half of people that applied for the fresh borrowing from the bank have been denied. Low-appeal disaster fund from the Small business Administration would be the simply federal government advice offered right to enterprises, but again, businesses did not have the new funds as accepted. Altogether, one-third from interviewed firms exactly who applied for a tragedy mortgage were accepted.