Imagine if your house cannot satisfy FHA Minimal Possessions Conditions (MPS) and you may offering due to the fact-is actually?

Imagine if your house cannot satisfy FHA Minimal Possessions Conditions (MPS) and you may offering due to the fact-is actually?

What the results are whenever property is being offered since the-are in addition to vendor will not perform repairs nevertheless the domestic will not meet FHA lowest possessions standards (MPS)? How come the consumer qualify for an FHA mortgage? It’s a great matter and you can a situation that takes place oftentimes.

It’s worthy of bringing-up your merchant try restricting their customer pool notably because of the not-being open to create repairs. Unless the consumer will pay cash, there will probably be things getting almost any financial support if the the home deficiencies is actually big.

But while the providers often should not place some other cent with the our home, listed below are some alternatives on precisely how to manage the trouble.

What is actually a keen FHA assessment?

Ahead of a home loan company tend to perform brand new FHA loan, they wish to be sure that your house will probably be worth exactly what the fresh borrower is purchasing they. A good HUD-accepted assets appraiser tend to measure the cover, integrity, and cost of the house, and report it into the an FHA form.

FHA Inspection List

- Structure: Is the framework of the property inside the good condition? Is there wetness, decades which may sacrifice the structure stability?

- Roofing: ‘s the rooftop planning to history 2 to 3 many years? Will it remain moisture away?

- Heating system, h2o and you can electronic: Does for each and every inhabitable area have an acceptable heating origin? (Legislation for this may differ according to seriousness of your local winter seasons.) Do water heating system fulfill local building rules? Digital boxes should not be damaged or provides unwrapped wides.

- Issues of safety: New FHA appraiser have a tendency to seek potential risks, such as asbestos or polluted crushed.

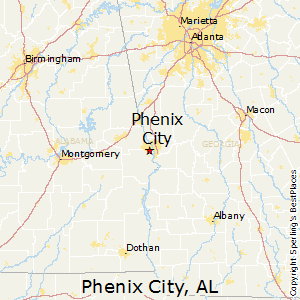

- Location: Our home must not be as well near to an unsafe spend webpages. And, distance to a lot of looks – such as for example hefty traffic, high-voltage electricity lines otherwise a keen airport – can prevent property from conference FHA guidance.

Brand new FHA appraiser or underwriter https://availableloan.net/payday-loans/ determines whether the possessions passes evaluation

Appraisers accepted in order to appraise having FHA capital know the FHA MPS standards. Once they get a hold of something which will not satisfy FHA guidance, they mention they about FHA assessment. Up until the concern is solved, the lender wouldn’t thing last recognition into financing.

But both, the FHA underwriter – who confirms conformity with FHA standards on the financial – have a tendency to find things regarding the assessment photo and you may need it is repaired. Advice try flaking paint or a questionable rooftop.

Can you imagine a house cannot meet with the FHA Minimal Possessions Standards?

So you can secure FHA investment into the property, someone should generate fixes on the household. This might be the seller, the customer, or periodically the actual property agent. Without solutions, you may have to envision option financial support options.

Alternative #1: The seller renders fixes

Even when the merchant states they don’t build repairs, they’ll either come around in the event the needed repairs was low priced or if they may be able do so by themselves.

Including, in the event the chipping painting ‘s the matter, owner should not have state tapping the newest area affected and purchasing $fifty with the painting. It’s low priced and simple.

Allow the realtors a copy of the house appraisal so they can see the situations firsthand. The brand new checklist agent could possibly encourage the vendor in order to create fixes to generally meet FHA criteria in the interests of closing.

Solution #2: The actual auctions build solutions

The real estate agents features a great deal to eliminate in case your deal will not intimate – commonly 3% of your cost. Hence, it can occur you to representatives work together to pay a few hundred or so or even a number of thousand dollars to be certain new possessions match FHA standards.