Lender Declaration Loan which have 700 Credit score

Lender Declaration Loan which have 700 Credit score

If you have a beneficial 700 credit score, you may be qualified to receive a lender declaration financing. There are several lender statement loan providers offering this type of programs to consumers that have an effective 700 credit history. You will find some of these loan providers less than.

Lender Report Mortgage brokers

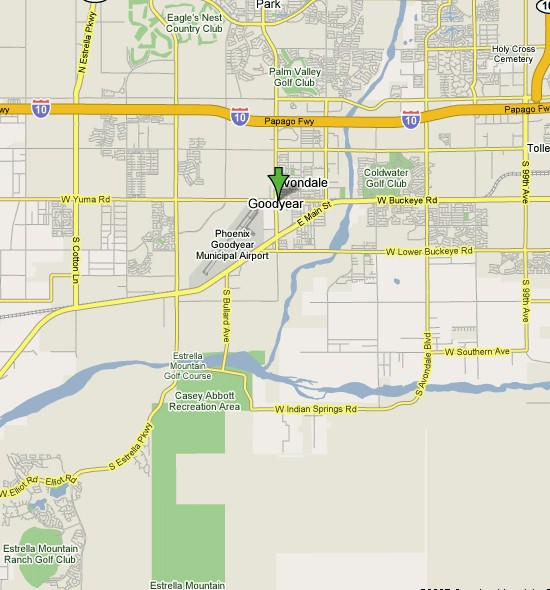

How would you like some help searching for a lender? We are able to matches you which have a lender that provides lender declaration funds on your location. The lending company that people suits you with can get the very least credit history requirements that’s lower than 700.

Bank Statement Loan Criteria

The standards to get a financial declaration mortgage hinges on the financial institution. Below is a few standard information regarding what conditions you could predict out of a bank declaration home loan company:

Bank Statements You’ll fundamentally need to complete possibly a dozen or two years worth of bank statements. With respect to the bank, you may be able to use often your own personal otherwise organization lender comments (or both). Extremely lenders will then take the mediocre of your complete earnings over-all several or a couple of years. You are able to have the choice to use only one days worth of financial comments which have a thirty days financial report system.

Advance payment The maximum LTV greet is oftentimes 90%, and thus the absolute minimum down-payment away from 10%. When you yourself have a lower credit history (especially significantly less than 580), you will want to expect you’ll need place nearer to 20% down.

Credit rating For every bank declaration lender has actually their unique lowest credit rating demands. When you have an excellent 700 credit score, you’ll meet up with the credit history conditions for the majority of bank report loan providers.

DTI Ratio Bank declaration mortgages succeed higher than typical debt-to-earnings percentages, with most loan providers allowing an optimum DTI proportion around fifty%.

Loan amount Maximum mortgage size differs from you to bank to another location. Some are capped within $2,one hundred thousand,100000, and others usually loan right up to $seven,five-hundred,000.

P&L Report Certain lenders requires a good P&L report (profit and loss declaration) that’s prepared by a great CPA. Not absolutely all loan providers will need an excellent P&L even though. Keep in mind, that in case there’s absolutely no P&L needed, usually simply personal financial comments meet the requirements to be used.

These are some standard conditions that you could expect of a lender declaration lender. If you prefer to see if your qualify for an effective lender report mortgage, we can assist fits your with a lender.

Frequently asked questions

Are there options to refinance that have a lender report system? Yes, your you can find choices to refinance the home loan which have a financial report program. This includes rate and you may label refinancing (to lower their rates and you can fee), including cash-out refinancing.

What other files and you can mortgage criteria usually are necessary to receive the borrowed funds? You really need to be prepared to be also required to at least submit a corporate permit and appraisal.

Could i keeps an excellent W-2 co-debtor? Yes, you can get a great co-borrower whom uses its W-2 taxation statements and you can money. They are verified in a timeless trend, along with your earnings that’s affirmed using lender comments.

The length of time does the method always attempt close the mortgage immediately after approved? For those who disperse quickly delivering precisely what is required people, a thirty day closing big date was sensible. Although not, of several money needs forty-five months (plus in rare cases even offered) to close off because of some explanations.

Are you willing to accept earnings obtained as a result of bank card cleaning properties? Yes, money that is obtained thanks to a charge card cleaning family, including PayPal, AMEX, otherwise Square may be used. Every earnings provide is actually received on a case by the instance foundation loans East Palatka, but provided the amount of money you can get is sensible for your own style of team, you’re able to utilize income away from present for example PayPal.

Could you rating a bank declaration financing for people who discover seasonal earnings? For folks who merely discover income to possess the main season, your . Their total income would be averaged out to possess both 12 otherwise 24 months, whilst enough time due to the fact month-to-month mediocre suits the required earnings requirements to suit your mortgage, you’ll be able to meet the requirements.

Do you require senior years money of these software? People old-age income that is transferred into your savings account is be studied while the being qualified money.

Have a tendency to having people NSF (low adequate funds) otherwise overdrafts on my family savings apply at my possibility of being qualified? Specific lenders will simply allow you to has actually to 3 complete NSF / overdrafts on your own membership in the good twelve times several months. You may found an exception, nevertheless will ultimately depend on the fresh underwriter to choose.

How do i determine if I am entitled to a financial declaration financing? It is easy to find out if you be eligible for a beneficial financial report mortgage. Whatever you should do is speak with a lender report bank, in addition they makes it possible to see if your be considered. If you prefer to see if youre eligible to possess a lender report loan, we could help meets you with a lender in your place.