P2P financing matches lenders that have borrowers who are in need of bucks easily

P2P financing matches lenders that have borrowers who are in need of bucks easily

Peer-to-fellow lending is when just one individual or an institutional investor brings loans funding to prospects otherwise enterprises compliment of on line properties (generally speaking an online site). It is known as markets lending or alternative funding because it is good means beyond your antique company credit practice.

Exactly who advantages from peer-to-peer credit?

Both the debtor as well as the financial can benefit away from peer-to-peer funds. The newest lender’s work with is they perform a stable money from desire costs, which often go beyond money from antique function eg Cds, rescuing account, and cash markets loans.

Toward borrower’s front side, just like the amount of attract charged to possess peer-to-peer fund is greater than antique loans from banks, the newest terms are usually so much more versatile. The web software procedure is sometimes quick and simpler.

P2P loan sizes

P2P funds become once the individual signature loans the good news is is organization fund too. Having your own P2P financing, you might acquire the court purpose, and you don’t have to vow security to find accepted to have financing.

Signature loans would be the most typical P2P funds, plus they are plus the very versatile. You can utilize the cash to the debt consolidation, a different vehicles, renovations, otherwise creating a corporate.

P2P loans also can are providers auto loans, business loans the real deal property, or layer a preliminary-label cash crunch. Smaller businesses and you will startups often utilize P2P money the absolute most.

Advantages of P2P credit

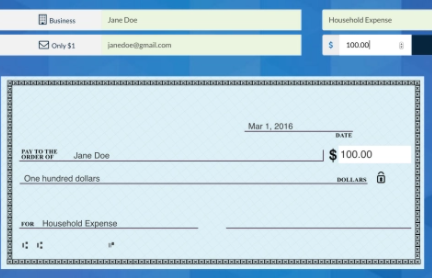

That have fellow-to-fellow lending, borrowers dont apply to a lender and other antique financial institution. Instead, they create a visibility on a web site you to will act as a great loan application. Dealers up coming feedback the internet users, if in case they prefer what they get a hold of, they supply a loan toward candidates.

Individuals aren’t needed to take-out any of the finance it are provided. Rather, they could feedback the brand new terminology and you can rates developed by certain traders, in addition they can decide which that they prefer. If they dont get a hold of financing that really works for them, they don’t have to take you to definitely. Regarding the P2P credit community, this can be described as the latest public auction techniques.

If you get a peer-to-peer financing, the newest P2P financing program brings https://cashadvancecompass.com/installment-loans-al/carolina/ a profile for your requirements, along with information about your credit score and obligations-to-money proportion. The P2P lender performs this a little in another way. Such as for example, some loan providers get tell you applicants’ credit ratings, although some will get assign An excellent, B, or C product reviews in order to individuals. Don’t be concerned: Regardless of if profiles is personal so that buyers can see him or her, they don’t incorporate their actual identity, making certain your confidentiality and shelter.

Cons from P2P financing

If you are credit ratings gamble a huge role, loan providers and credit associations also are looking why you you need that loan. That it the main application shall be critical to attracting good financial or investor. An investor exactly who notices an enticing software is generally apt to be bring financing to this candidate rather than individual who cannot certainly identify the point on the loan, even if the next candidate features a far greater credit score.

Applying for an equal-to-fellow financing is actually probably smaller than simply obtaining a corporate mortgage by way of a financial, specifically since the individuals don’t have to manage lengthy company plans. not, P2P software take more time than making an application for financing off online lenders and you can obtaining a credit card online.

With many different online loan providers an internet-based credit card apps, a decision might be made in just a few seconds. Having on the web finance, specifically, investment can happen a similar time or even the 2nd business day. With peer-to-peer money, acceptance and you may investment moments are different. Given that individuals need hold back until a trader gets seeking its users, the method can take from around a couple of minutes, a few days, to some months.