Summing up How to get a home loan Once Transferring Jobs to help you An alternate Condition

Summing up How to get a home loan Once Transferring Jobs to help you An alternate Condition

You’ll find nothing incorrect which have and make a general change in your own a position that leave you so much more satisfied and happy. But not, loan providers hate observe extreme changes in the brand new designs regarding a job.

Consider the earlier samples of the brand new baseball mentor you to took toward the same part from the a new college or university plus the taxation accountant you to definitely took on an equivalent occupations from the a much bigger company. Those people are samples of some body climbing up inside their world and receiving recognized for the profitable functions.

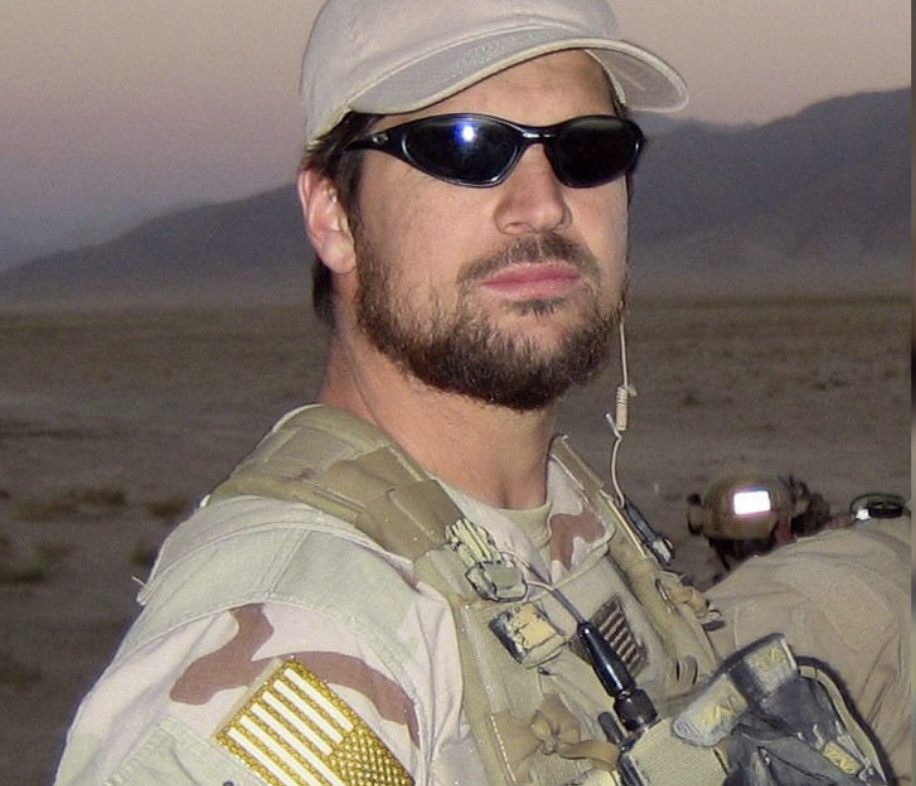

Compare one to so you can one called Walt exactly who currently performs because an officer and you may decides to walk off from the push and start a job as a beneficial car salesperson.

Walt could end right up performing fewer circumstances and you will making a lot extra cash. But he will need couple of years in the their the brand new employment just before they can sign up for a mortgage.

This is certainly undoubtedly one of the most common types of anybody switching its distinctive line of works which causes difficulties with their mortgage application.

Such, imagine men entitled Taylor has worked to have a flooring organization to have 10 years given that a carpet installer. One day, the guy decides to get off the firm and start his personal business since the a carpet installer, one or two thousand far away regarding his old household. The guy will get business cards generated, talks to every his relationships, and you will advances loan place in Hawleyville the expression about his the fresh providers.

Taylor are a roaring victory with his new business. But the simple fact that the guy remaining their stable W-2 a job as a member of staff and turned a business owner commonly limitation him off bringing approved getting home financing.

He’ll need establish that have business tax returns as well once the personal tax returns one their the latest organization is successful and you may pays him enough to afford a mortgage. This will merely happen just after he’s got been in company to possess at least 2 yrs.

An equivalent would be said for anyone you to has worked due to the fact an enthusiastic It professional and you can decided to go from his own once the a consultant so you can his old boss. As he elizabeth staff member classification as the he could be today a consultant and a personal-functioning individual.

Paperwork is vital

The main thing to consider with these occupations changes try papers. Regardless if you are bringing a conventional financing such as for example good Freddie Mac computer otherwise Fannie mae loan otherwise choosing a national-supported loan for example FHA or USDA, lenders may wish to get a hold of all things in composing.

According to the brand of financing and people specific lender overlays, the deal letter might need to incorporate particular wording

Consequently make an effort to document your existing money with pay stubs, w-2 forms, and personal tax statements.

What’s more, it implies that you will need to file new income from the new occupations. A proper employment offer letter are expected. Their financial can give you an example presenting to help you your employer if necessary.

The key takeaways throughout on the is actually rather obvious. When you are providing career advancement in the same business when you look at the an alternate county, and you’ve got a track record of doing work in you to business within the last lifetime, you ought to come across your self for the a strong updates to put on to have an alternative financial on your own the brand new county out of household.

A lot more Beneficial Home loan Information having Home buyers:Providing pre-approved to own a mortgage is just one of the most readily useful things will perform ahead of deciding on house. Whether you are a first and initial time household consumer or perhaps not, this ought to be priority no. 1! Check out this blog post of the Lynn Pineda understand everything you need to discover home financing pre-recognition.