Tips for Maximizing the great benefits of Zero-Focus Home improvement Finance

Tips for Maximizing the great benefits of Zero-Focus Home improvement Finance

Other fund are specially setup to own older people, having residents of certain specific areas, and people who have poor credit just who ple.

To access a loan, possible first need identify groups offering them in your area. You’ll then need certainly to determine whether your meet the requirements according to research by the regards to the specific finance. In the event you, you’ll apply and, if the winning, discover service for the need do it yourself opportunity.

A regular borrowing cap is just about $18,000 so you can $35,000. It is uncommon locate Hip finance in the half dozen rates. Specific components render matching fund doing a specified restrict.

Those who be eligible for a no-interest loan to have renovations will likely see its really worth the red-tape involved in implementing as it lets them fund good costly investment during the considerable deals. In a single prominent situation, a state regulators you’ll subsidize 350 basis situations of loan’s interest rate. Specific counties assist arrange 0% financing needless to say strategies, eg boosting a beneficial house’s energy efficiency.

Why don’t we manage the latest number having a partially backed financing. This situation regarding an excellent five-year $20,000 mortgage measures up your will cost you which have and you may rather than mortgage reduced amount of 350 foundation affairs.

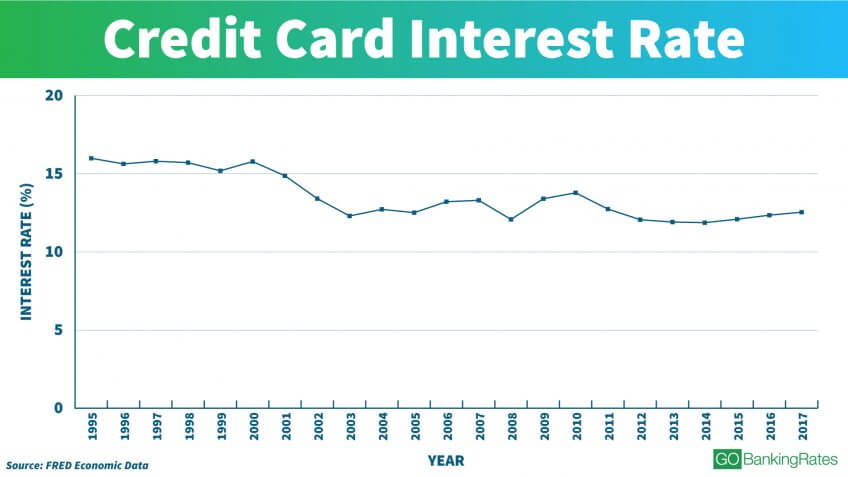

- Without having any subsidy: Which have an effective 4.5% interest rate, you’ll shell out regarding $372 monthly. Complete notice is actually $dos,371.

- With the subsidy: Into the interest rate from the step 1%, you will shell out throughout the $341 a month, getting a savings of around $29 four weeks. Overall desire try $512.

By using out the Cool-build mortgage in this instance, you’d help save $step one,859 in the interest. In case the financing is actually completely subsidized or focus-100 % free, brand new savings may potentially become even higher.

Cost management, Think, and you may Prioritizing

Just as you have to be organized when trying to get a great zero-attention home improvement financing, you will need to carefully plan out your work managed to attain limitation savings. One of the first actions in order to this is knowing the can cost you of every projects you’re considering. Create a resources off estimated expenses centered on rates of contractors and other experts who you are going to complete the venture, and make certain to cause for how much these types of improvements might beat preexisting will cost you (like stamina) or enhance the value of our home.

In some instances, property improve financing will need you to complete the associated enterprise inside a particular schedule. In this instance, which have an idea that you know it is possible to play in limits of financing words is very important. It may be had a need to choose one enterprise over another you have in mind by the schedule.

In the long run, prioritizing one project from a lengthier list helps you to optimize discounts. Say that you happen to be entitled to a loan which takes care of around $20,000 of your own price of you to definitely opportunity. If you have you to definitely project having an estimated price of $a dozen,000 and something online payday loans no fax having a projected price of $24,000, you might be better off opting for the larger opportunity, whenever you can make up the real difference oneself. Actually dipping in the individual money, you’ll nevertheless be finest in a position to benefit from the mortgage promote. Obviously, which depends on the terms of your specific financing.

As to why Counties and you may Nonprofits Bring Such Financing

Counties and lots of nonprofits has a good mandate so you can serve owners, specifically reasonable-earnings household. With the a larger measure, counties have an interest in keeping the worth of construction stock. When property inventory refuses, the general well being declines. In the long run, getting these fund pushes the economical host by the helping manage ideas that induce services.